when will i get the unemployment tax refund 2021

In mid-July the IRS issued 4million refunds of which those by direct deposit landed in bank accounts from July 14. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

More unemployment tax refunds coming irs says.

. In March when the American Rescue Plan passed many people had already filed returns and paid taxes on all of their benefits. February 18th 2022. The IRS has identified 16.

WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent. Getty When will I get my jobless tax refund. Around 540000 minnesotans can expect to get a tax refund with the first 1000 payments going out this week.

Watch popular content from the following creators. So if you collected unemployment benefits in 2021 you should expect 100 of your benefits to be included in your taxable income when you file your 2021 tax return. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person.

However the irs has not yet announced a date for august payments. Check For the Latest Updates and Resources Throughout The Tax Season. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

The IRS normally releases tax. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. ET The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in.

During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. 22 2022 Published 742 am. The federal tax code counts jobless benefits as.

IR-2021-71 March 31 2021. How To Get A Refund For Taxes On. Article continues below advertisement Source.

You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. President Joe Biden signed the pandemic relief law in March. The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American.

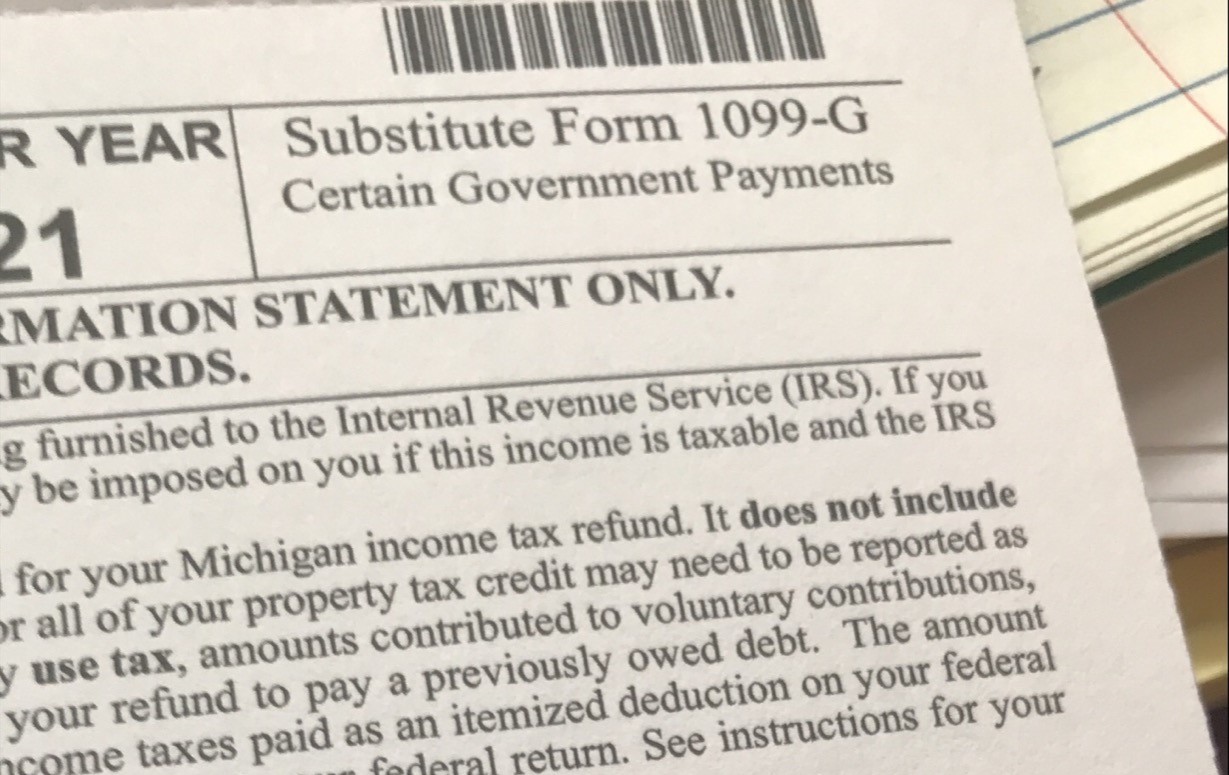

Benefits can help to keep your family afloat so you can meet expenses until you find work again. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. Unemployment can be a lifeline to those dealing with a sudden job loss.

Millions of Americans claimed unemployment benefits in 2021. Refunds to start in May. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in.

You did not get the unemployment exclusion on the 2020 tax return that you filed. The unemployment refund is a refund for those that overpaid taxes on their 2020 unemployment. Meanwhile households who receive the cash refund by paper check could expect this from July 16.

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. 24 and runs through April 18.

July 29 2021 338 PM 1 You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true. System to follow the status of your refund. The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during 2020.

IR-2021-159 July 28 2021. The IRS unemployment tax refund recalls the incident of returning the taxes that were given over the unemployment benefits. But it notes that as it continues to review more complex returns the process will continue into 2022.

How much taxes do you pay on unemployment. December 28 2021 at 1013 pm. You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7.

Another batch of payments were then sent out at the end of July with direct deposits on July 28 and paper checks on July 30. Tax season started Jan. IRS to recalculate taxes on unemployment benefits.

You may check the status of your refund using self-service. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. Unemployment Insurance Tax Refund 2021.

September 20 2021 511 PM. If you received unemployment benefits last year and filed your 2020 tax return relatively early you. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

Those refunds are supposed to keep coming through the end of summer. It says it plans to issue another batch of these special refunds before the end of the year. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

The IRS is expected to continue releasing the refunds throughout 2021. 24 and runs through April 18. Unemployment tax refunds may not arrive until NEXT YEAR warns IRS Joy Dumandan 1238 ET Dec 24 2021 MILLIONS of Americans are wondering when they will get their tax refunds as the Internal Revenue Service IRS says 62million 2020 individual tax returns still remain unprocessed.

Tax unemployment refund 2021 1304M views Discover short videos related to tax unemployment refund 2021 on TikTok. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. Unemployment Income Rules for Tax Year 2021.

Kim CPAkim_cpa Mr Nelzoncredittaxstrategisnelz Carrie Petty Turnagecarrieturnage News Consumeryaimacrespodigital Conservative mommaraisingmylillies. Unemployment numbers surged at. 1222 PM on Nov 12 2021 CST.

This story is part of Taxes 2022 CNETs coverage of the best tax software and everything else you need to get your return filed quickly accurately and on-time.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Usa

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

![]()

What To Know About Unemployment Refund Irs Payment Schedule More